Real Estate Market Update: What Happened in San Mateo County?

The San Mateo County real estate market in July 2024 has slowed down. The number of days on the market increased from 19 days in June 2024 to 21 days in July. Prices per square foot of living space decreased from $1,224/SqFt to $1,200/SqFt for these same months, along with the number of sales (354 vs. 315). Home prices in San Mateo County are still down 10% compared to May 2022 but are up 6% year-over-year.

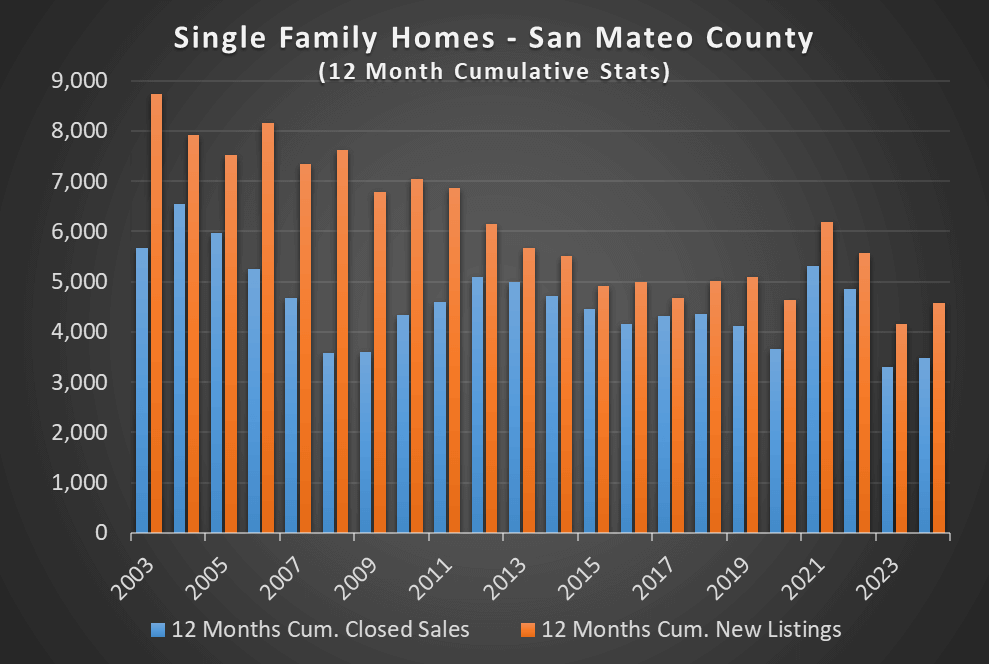

Looking at the last 12 months, the quantity of new listings and sales has improved substantially over the previous 12 months (4,570 vs. 4,155). On average, we get about 5,000 homes listed each year. 2023 was very lean in new listings, while 2021 and 2022 were monster years.

What does this real estate market update mean?

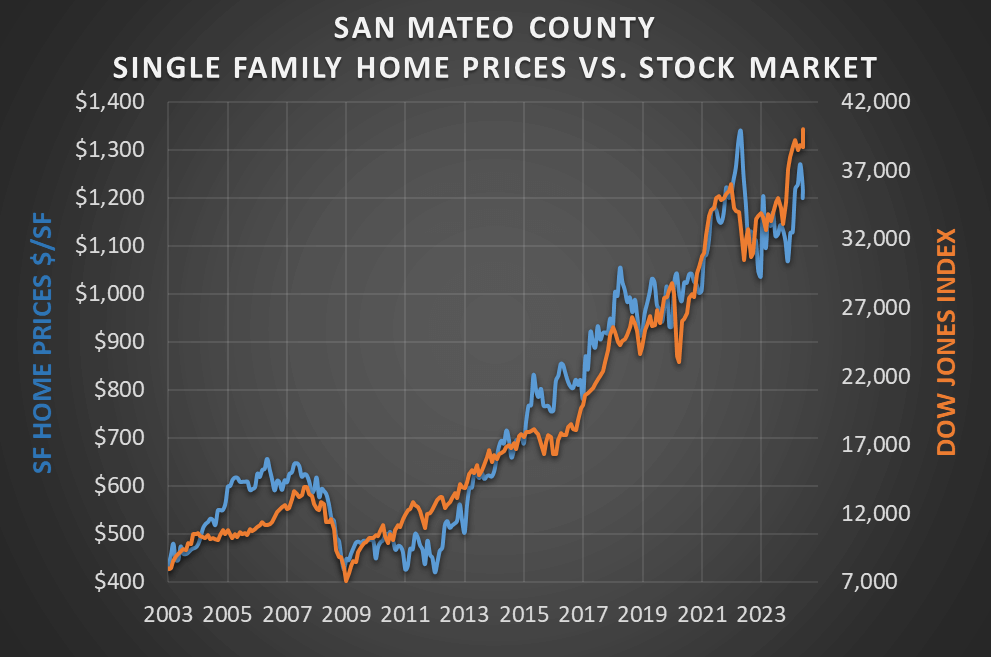

The price drops and slower sales simply mean that it was July. Traditionally, this slowdown occurs when comparing June to July sales. People go on vacation, and things tend to slow down. The average single-family home price dropped from $2.70 million to a bargain of $2.52 million. Despite interest rates remaining high, the 6% year-over-year increase in home prices makes sense because the stock market performed well over the same period, with the Dow Jones Industrial Average (DJI) up 18%.

What should you do?

To start, call us if you’re thinking about buying or selling a home (sorry couldn’t help myself).

Right now, there is too much uncertainty to offer sound advice regarding this real estate market update. One thing COVID taught me is that when the unknown comes along, predictability goes out the window. When the economy froze at the start of COVID, I believed home prices would come down; I could not have been more wrong. At the moment, we are entering an election cycle, and the crystal ball is broken.

We have two parties promoting very different policies, which may significantly impact the economy, employment, and inflation.

If we stay the course, those selling and then buying another home will still suffer from sticker shock if they need to finance their new purchase—rates remain high. The ‘experts’ seem to believe the Fed will lower rates in September, which might be the start of future rate drops. However, we are not going back to 3%. Experts are discussing that rates may get down to around 5% in 2026. This should be good for sellers, but meantime the macro economy is showing some weakness with lower than expected job creation and rising unemployment.

The obvious issue is that first-time buyers are facing huge affordability challenges: high home prices and high interest rates. I think first-time buyers need to engage in considerable life planning. What is their current income versus realistic future income potential? Will purchasing a home deplete their ability to save for retirement or anything else? Many buyers not earning significant income through employer stock options (RSUs) are struggling.

Selling or buying a home in San Mateo or Santa Clara?

Seek people who will put their full effort into representing your interests, treat you like a person and not a transaction, and experts who are well-respected in their profession. With over 30 years of combined experience and 95% of their clients coming from referrals, we take great pride and joy in exceeding your expectations.