I know that home prices seem like they are out of control; the average single family home in San Mateo County is selling for $2,700,000. While that may seem insane to most people, Restricted Stock Units (RSUs) make it possible. Homes in the region are actually getting cheaper for those whose majority of their income is derived from those RSUs. Nvidia alone has supposedly created thousands of millionaires over the past few years. The wealth creation via IPOs is also immense in this region.

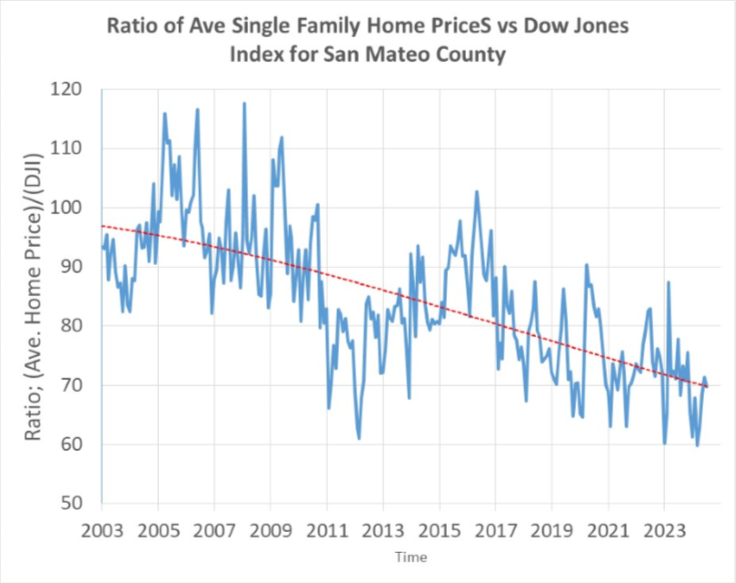

It is interesting how the ratio between the DJI and home prices has decreased over time. Around 2003, the average home sold for about 90x of the DJI, but today homes are selling for around 70x the DJI. Most of this decline happened since 2010. So for those making the majority of their income off the stock market, homes have become cheaper relative to their source of income.

Although those making money off highly profitable RSUs do not make up the entire homebuyers market. I think otherwise homes might be even more expensive as only those making insane amounts of money competed for homes. Although, with home prices where they are, it’s difficult to envision a teacher, nurse or plumber being able to afford a home. You’d probably disagree with me considering what you paid your last plumber!

Can Anyone Afford to Buy a Home without RSUs in the Bay Area?

Let’s put this into perspective; someone buying the average home today and only putting down 20%, can expect to pay approximately $17,000/month for their mortgage, property taxes and home insurance (PITI). If a lender was willing to make a loan based on 40% of the buyer’s gross income, the buyer would need to make $510,000/year gross to qualify. Plus the lender might require them to have two years of reserves in the bank. This seems insane and out of reach for most people if they don’t have RSU income to supplement their salaries.

While a dual income household with two well educated professionals working in high-tech or a biotech company might be able to scrape by, they will struggle! Think about it, if their combined income is $510k then after taxes, they might take home $306k. The PITI on the home is $204k/year, which leaves $102k for everything else. If you have car payments, students loans, child care or maybe a couple kids heading off to college and you like to eat three times per day… there’s not much left over! How did we arrive at where half a million dollars per year of income only allows someone to buy an average home and scrape by?

Even a modest condo is out of reach for many. They cost $1m and with a 20% down payment the cost is about $7,000/month when you account for PITI plus HOA fees. You need an income of at least $200k/year gross to afford that… and barely scrape by.

Viv and I meet many older sellers whose home equity is the majority of their retirement assets. Increasing home prices have been great for those folks. However, our hearts do go out to the young people we meet working none high-tech jobs that want to buy a home and feel like that will never become a reality as long as they live in the Bay Area.

Selling or buying a home in San Mateo or Santa Clara?

Seek people who will put their full effort into representing your interests, treat you like a person and not a transaction, and experts who are well-respected in their profession. With over 30 years of combined experience and 95% of their clients coming from referrals, we take great pride and joy in exceeding your expectations.

More info about Vabrato

Contact Us